Offer Ends 31st December 2024

Struggling with Your Uber Driver Taxes?

Many Uber driver partners pay too much tax, miss deductions, and worry about compliance.

With complex rules and limited support, it’s easy to feel lost. TaxLeopard simplifies the process, helping you save money and stay stress-free.

TaxLeopard:

2-In-1 Tax Software + Accounting Services

We specialise in making taxes easier for Uber driver partners and gig workers, helping you pay less tax and keep more of your hard-earned money.

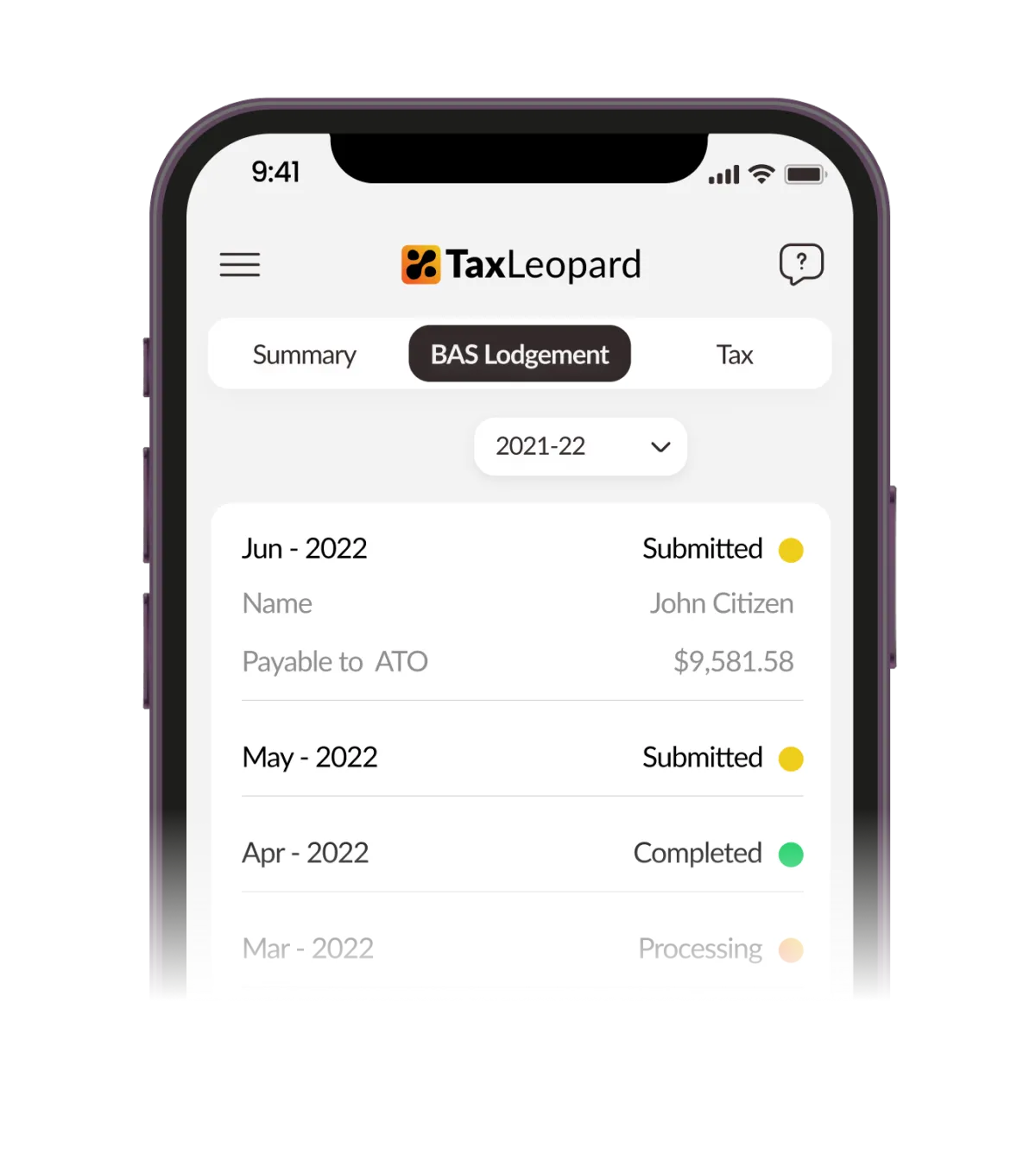

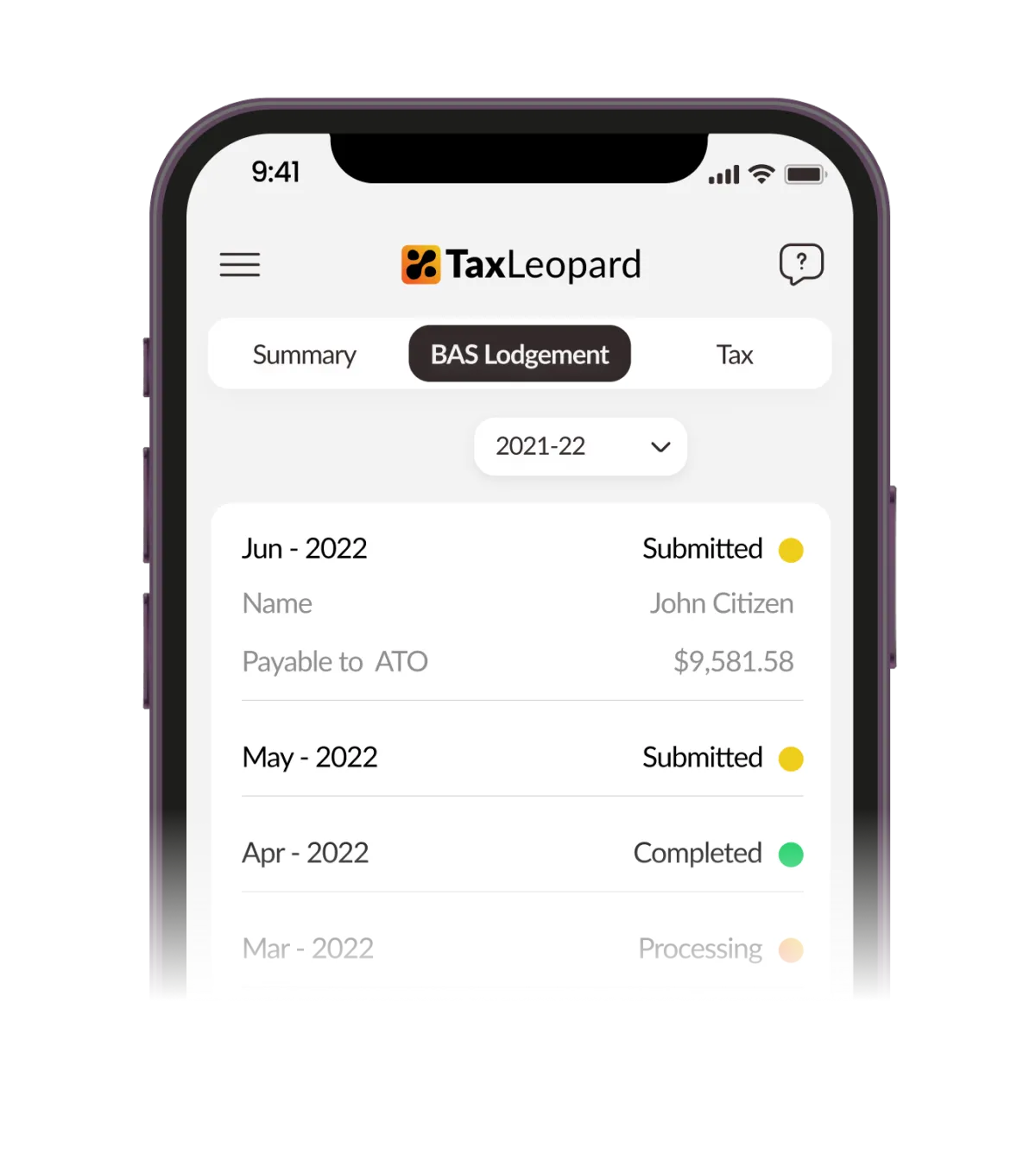

Easy Tax Returns

and BAS

Submission

Lodge your Business Activity Statement (BAS) and tax returns easily, anytime.

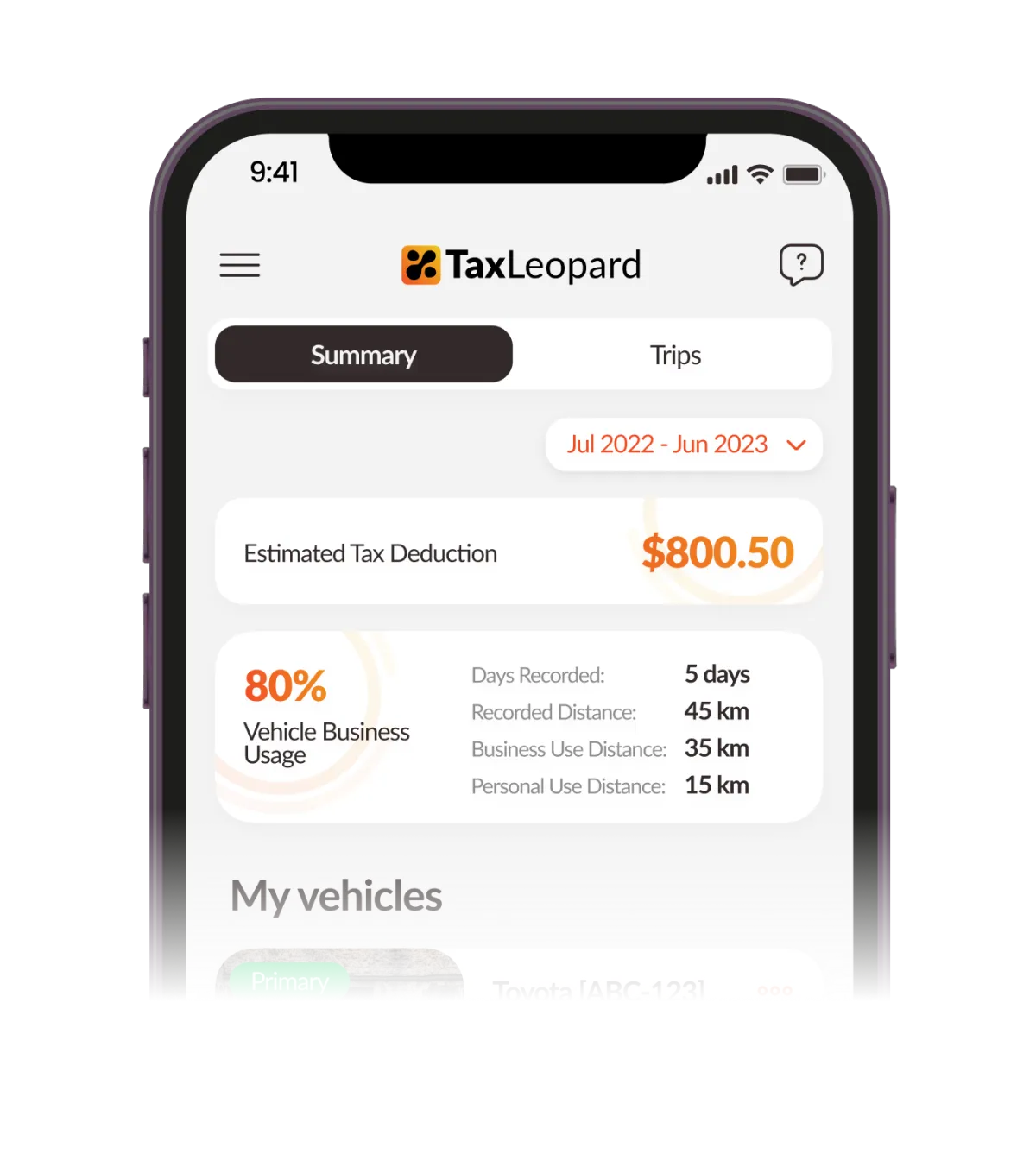

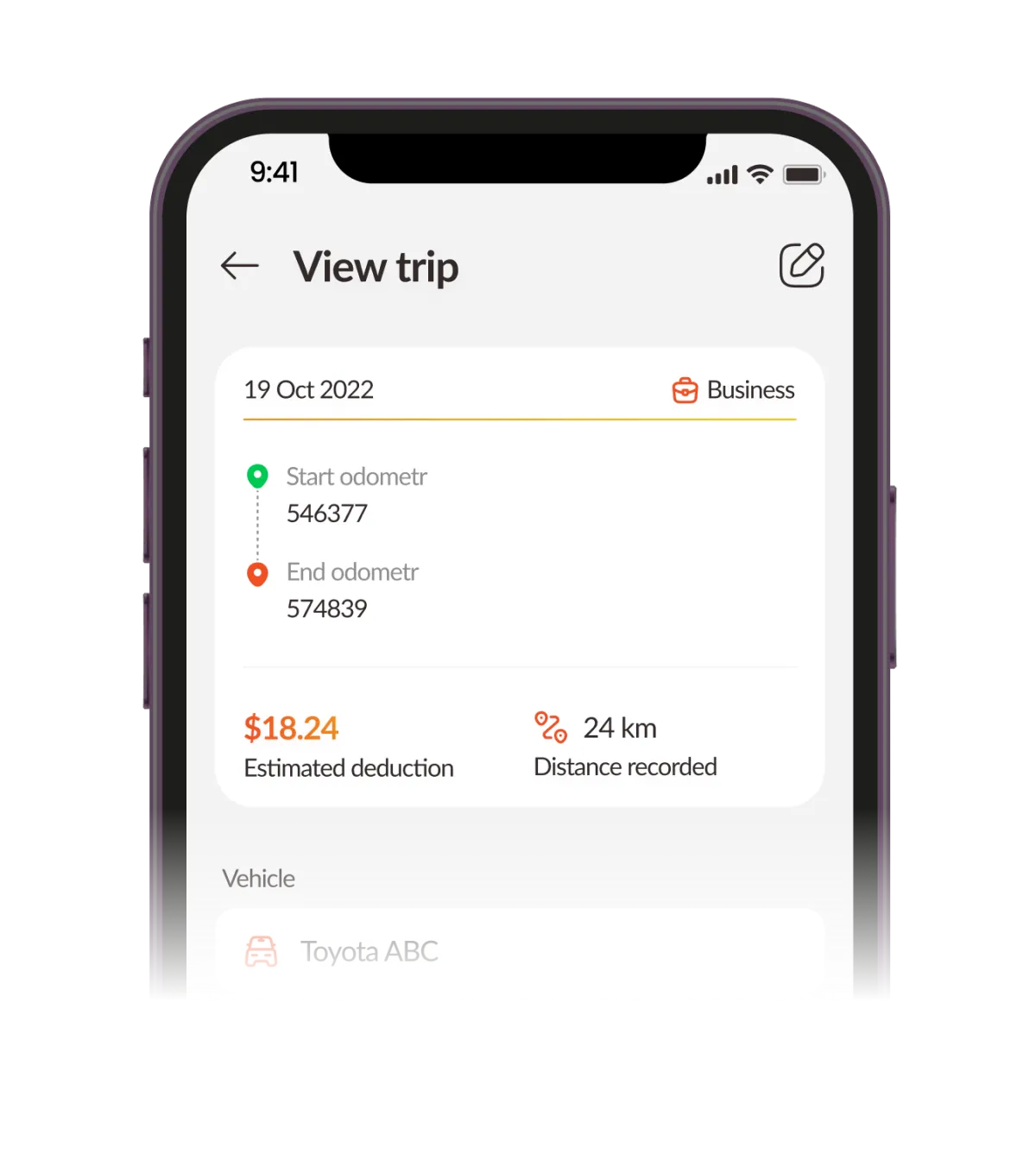

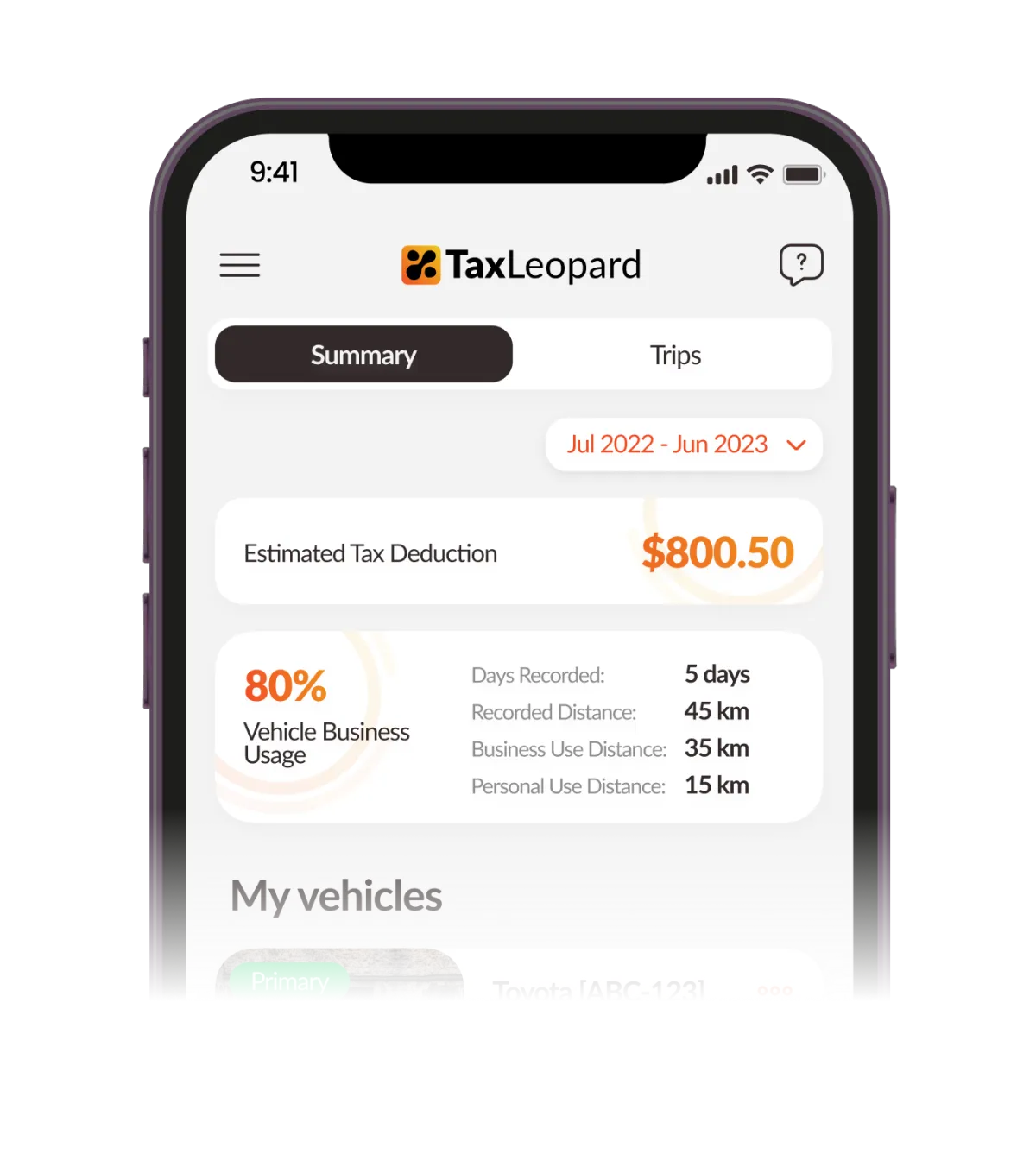

Easily track

your digital

car logbook

Track your car’s business use and claim every dollar you’re entitled to.

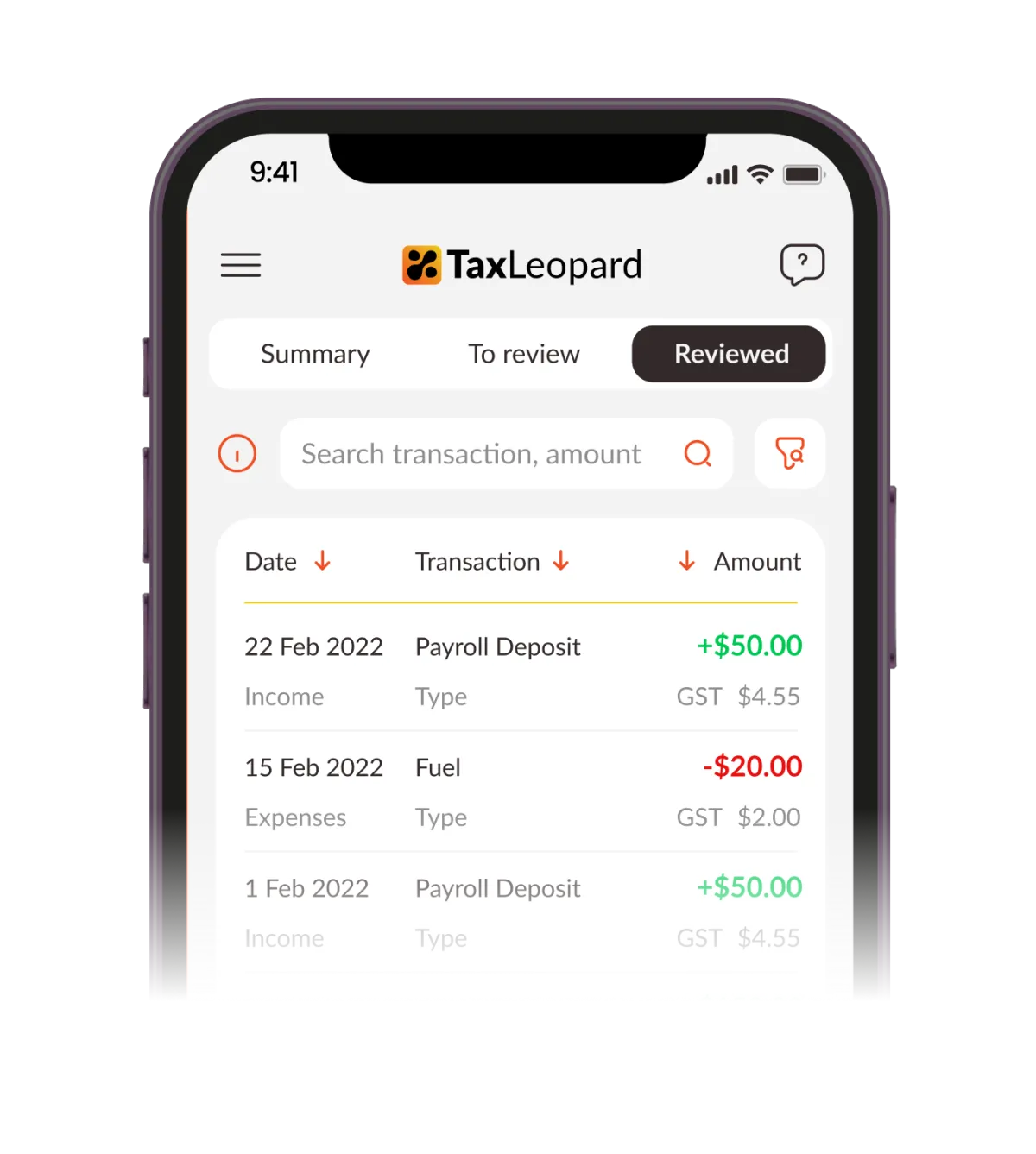

Import Uber

Income and

Expenses

Connect your bank account to download all income and expenses

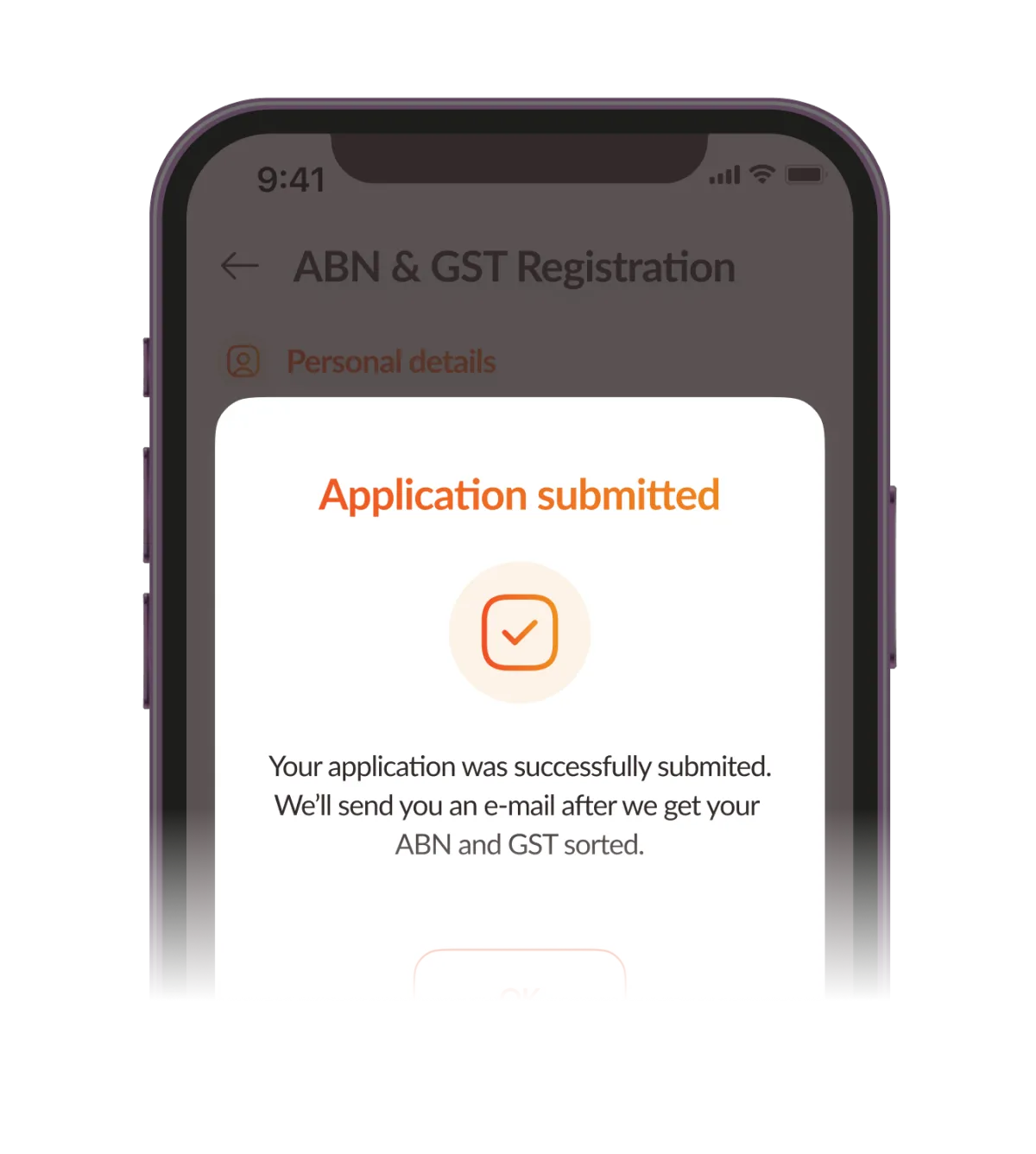

GST Dashboard & Secure Lodgement

Track your GST liabilities or refunds at every step while ensuring your BAS and returns are safely and securely filed with the ATO.

Designed for Uber Driver Partners

User-friendly platform with CPA tax accountants specialising in rideshare, dedicated to helping you pay less tax.

Join the thousands of Uber driver partners already using TaxLeopard

Save $60 on Tax Return services with TaxLeopard

Pay less tax with our exclusive Uber partnership!

Save $60 on tax return services with TaxLeopard. Skip the ATO stress and file your return easily.

Enjoy $60 off

— now just $119 instead of $179.

Struggling with Your Uber Driver Taxes?

Many Uber driver partners pay too much tax, miss deductions, and worry about compliance.

With complex rules and limited support, it’s easy to feel lost. TaxLeopard simplifies the process, helping you save money and stay stress-free.

Claim Your $60 Discount and Relax -

Pay Less Tax Today with TaxLeopard!

Certified Experts: Our CPA accountants are former Uber drivers who truly understand your needs. We’re here to help you save money with every step.

FAQ's

What Makes TaxLeopard Different?

TaxLeopard combines easy-to-use tax software with expert CPA accountants into one seamless solution. Unlike traditional methods, our platform simplifies expense tracking, maximises deductions, and makes BAS and tax return submissions secure, affordable, and straightforward for rideshare drivers.

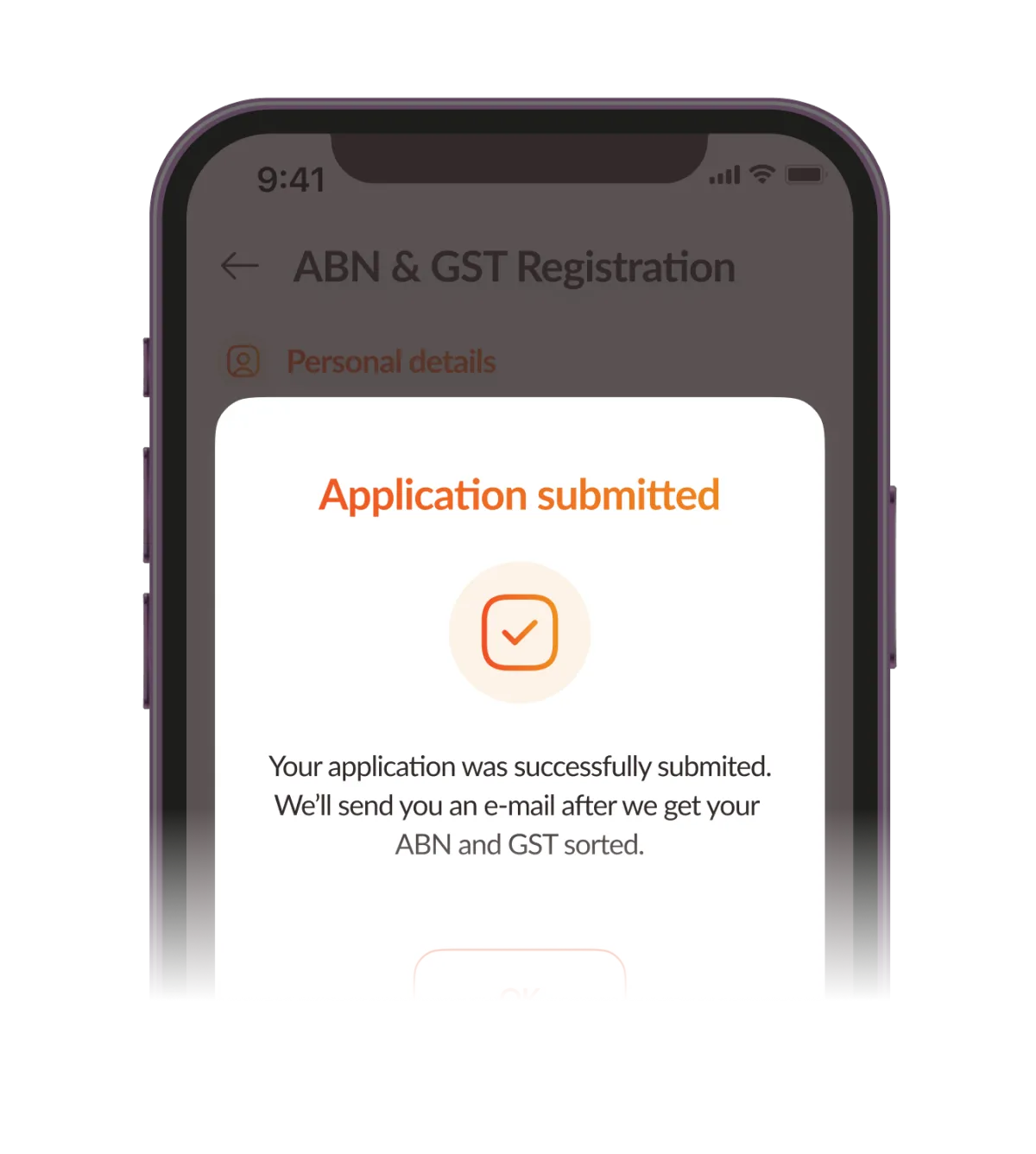

Do Uber driver partners need to register for GST?

Yes, Uber driver partners must register for GST from their first dollar of income as per the ATO rules. Unlike other businesses, rideshare drivers don't get a $75,000 threshold. The money you make from Uber includes GST, which you need to report and pay to the ATO through your BAS.

Do I need to lodge a BAS?

As an Uber driver partners, you need to be registered for GST and lodge a Business Activity Statement (BAS). The BAS reports the GST you collect from customers and the GST you pay on business expenses. Most drivers lodge their BAS quarterly, but some may do it monthly depending on their circumstances.

Are Uber driver partners considered independent contractors?

Yes, Uber driver partners are independent contractors. This means you are self-employed and need to manage your own taxes, superannuation, and insurance. Unlike employees, who have taxes automatically taken out of their pay, you must handle all your business expenses and tax obligations yourself.

Can I claim my car expenses on my BAS?

Yes, you can claim car expenses like fuel, maintenance, insurance, registration, and depreciation on your BAS, as long as they are for business use. Just be sure to keep accurate records and receipts.

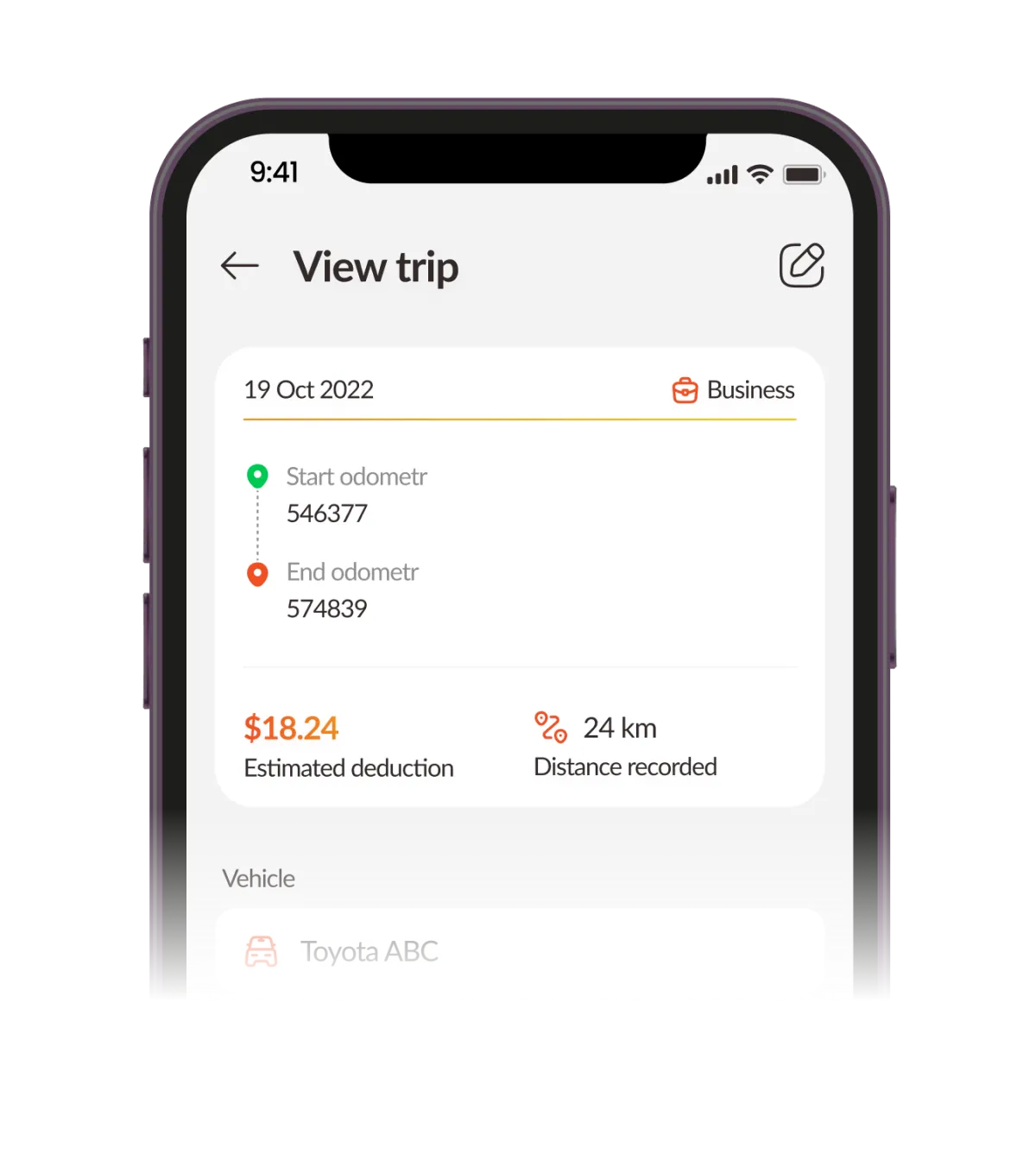

Do I need a car logbook?

Yes, a car logbook is important for claiming vehicle expenses. It tracks how much you use your car for business, which helps you calculate your deductions. You need to keep a logbook for 12 continuous weeks, and it stays valid for five years as long as your driving habits don't change.

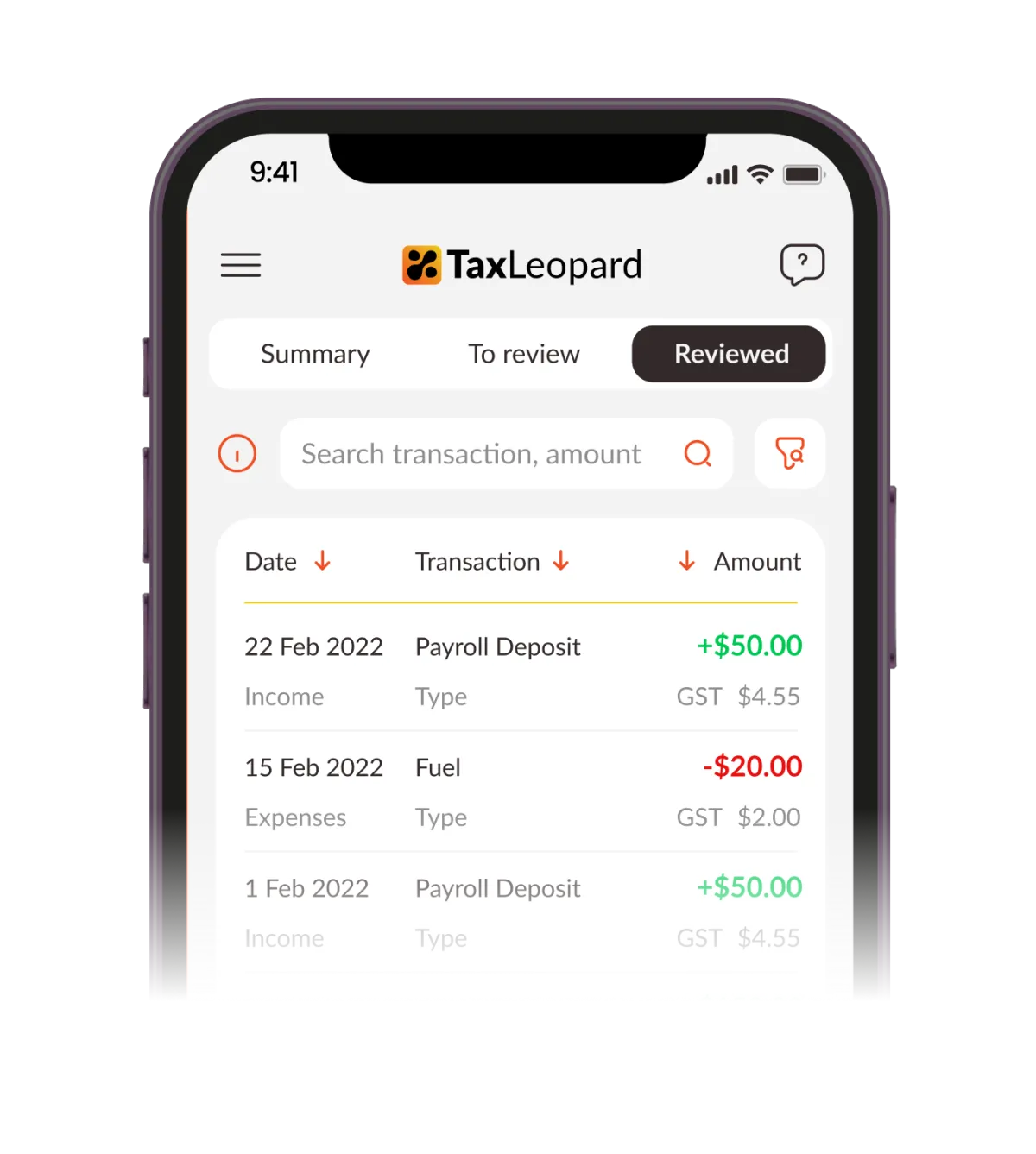

Connecting your bank account and downloading your Uber income

TaxLeopard lets you securely link your bank account to automatically import your Uber income and other business income and expenses. This makes it easy to track your earnings and expenses, keeping your records accurate and up to date for tax filing and BAS lodgement.

Seamless Tax Returns for Uber Driver Partners

Link your business bank account to download your income and expenses. If you've lodged your BAS with TaxLeopard, import your data into the tax return form. Answer a few questions, and our accountants will review and submit your tax return to the ATO, always finding ways to help you save on taxes!

Can I claim the cost of purchasing or renting my car?

Yes, you can claim the cost of purchasing or renting your car if it's used for business purposes. For a purchased car, you can claim the depreciation over time rather than a full deduction at once. You can also claim related expenses like interest on a car loan. For a rented car, you can claim the rental costs.

TaxLeopard:

2-In-1 Tax Software + Accounting Services

We specialise in making taxes easier for Uber driver partners and gig workers, helping you pay less tax and keep more of your hard-earned money.

Easy Tax Returns and BAS Submission

Lodge your Business Activity Statement (BAS) and tax returns easily, anytime.

Easily track your digital car logbook

Track your car’s business use and claim every dollar you’re entitled to.

Import Uber Income and Expenses

Connect your bank account to download all income and expenses

GST Dashboard & Secure Lodgement

Track your GST liabilities or refunds at every step while ensuring your BAS and returns are safely and securely filed with the ATO.

Designed for Uber Driver Partners

User-friendly platform with CPA tax accountants specialising in rideshare, dedicated to helping you pay less tax.

Join the thousands of Uber driver partners already using TaxLeopard

Claim Your $60 Discount and Relax -

Pay Less Tax Today with TaxLeopard!

Certified Experts: Our CPA accountants are former Uber drivers who truly understand your needs. We’re here to help you save money with every step.

FAQ's

What Makes TaxLeopard Different?

TaxLeopard combines easy-to-use tax software with expert CPA accountants into one seamless solution. Unlike traditional methods, our platform simplifies expense tracking, maximises deductions, and makes BAS and tax return submissions secure, affordable, and straightforward for rideshare drivers.

Do Uber driver partners need to register for GST?

Yes, Uber driver partners must register for GST from their first dollar of income as per the ATO rules. Unlike other businesses, rideshare drivers don't get a $75,000 threshold. The money you make from Uber includes GST, which you need to report and pay to the ATO through your BAS.

Do I need to lodge a BAS?

As an Uber driver partners, you need to be registered for GST and lodge a Business Activity Statement (BAS). The BAS reports the GST you collect from customers and the GST you pay on business expenses. Most drivers lodge their BAS quarterly, but some may do it monthly depending on their circumstances.

Are Uber driver partners considered independent contractors?

Yes, Uber driver partners are independent contractors. This means you are self-employed and need to manage your own taxes, superannuation, and insurance. Unlike employees, who have taxes automatically taken out of their pay, you must handle all your business expenses and tax obligations yourself.

Can I claim my car expenses on my BAS?

Yes, you can claim car expenses like fuel, maintenance, insurance, registration, and depreciation on your BAS, as long as they are for business use. Just be sure to keep accurate records and receipts.

Do I need a car logbook?

Yes, a car logbook is important for claiming vehicle expenses. It tracks how much you use your car for business, which helps you calculate your deductions. You need to keep a logbook for 12 continuous weeks, and it stays valid for five years as long as your driving habits don't change.

Connecting your bank account and downloading your Uber income

TaxLeopard lets you securely link your bank account to automatically import your Uber income and other business income and expenses. This makes it easy to track your earnings and expenses, keeping your records accurate and up to date for tax filing and BAS lodgement.

Seamless Tax Returns for Uber Driver Partners

Link your business bank account to download your income and expenses. If you've lodged your BAS with TaxLeopard, import your data into the tax return form. Answer a few questions, and our accountants will review and submit your tax return to the ATO, always finding ways to help you save on taxes!

Can I claim the cost of purchasing or renting my car?

Yes, you can claim the cost of purchasing or renting your car if it's used for business purposes. For a purchased car, you can claim the depreciation over time rather than a full deduction at once. You can also claim related expenses like interest on a car loan. For a rented car, you can claim the rental costs.

Copyright © TaxLeopard 2024. All Rights Reserved.

Our mailing address is:

Copyright © TaxLeopard, All rights reserved.

Our mailing address is:

[email protected]